The AOB game continues

Just a few days before Hurricane Ian struck, the sixth Florida homeowners insurance company this year was declared insolvent by regulators. Meanwhile Richie Kidwell and his Air Quality Assessors lose another AOB case in court, while Citizens Property Insurance cites such lawsuits as an “increasing problem” in the insurance crisis and reveals a new AOB trick being used by contractors. It’s all in this week’s Property Insurance News.

FedNat: The day before Ian struck, a judge approved the petition for Consent Order appointing the Florida Department of Financial Services as a receiver for FedNat Insurance Company. It’s the sixth such Florida insolvency this year. Regulators had approved FedNat’s runoff plan in May that involved cancelling 56,500 policies and transferring another 83,000 to sister company Monarch National. But FedNat notified regulators in mid-September that it didn’t have enough money to execute the runoff plan.

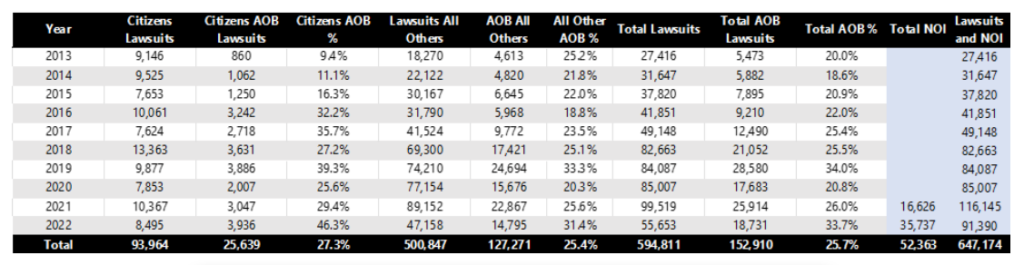

Citizens: Citizens Property Insurance President Barry Gilway said at the recent Board of Governors meeting that the company “is a rollercoaster ride as a direct result of the insolvencies” due to profitability in the private market. Referencing the eight insolvencies and five consent orders since late 2019, he said Citizens has picked-up 35% of those policies, with a policy count that’s now 1,072,000 at last report. Also troublesome: Litigation continues to increase, driven in part by an growing number of Assignment of Benefits (AOB) lawsuits from attorneys mining older claims that recent reforms don’t apply to.

Chief Claims Officer Jay Adams explained that “Claims prior to HB 7065 taking effect (the 2019 reform legislation) is where all the AOB’s are related now and that is driving 50% or more of our new claim volume month over month.” He said that contractors who filed AOB claims on events prior to HB 7065 are going back and amending those claims. So there is no two-year limit involved nor really the old three-year limit involved in filing lawsuits, because both of those restrictions apply to filing the initial claim. So Citizens will have to litigate these amended claims under the old rules on attorney fees prior to HB 7065.

It’s an AOB: Florida’s 2nd District Court of Appeal has upheld a victory by American Integrity Insurance Company against a well-known Orlando area mold remediation firm in a case involving an Assignment of Benefits (AOB) contract. Richie Kidwell, owner of Air Quality Assessors, sued the company for breach of contract in a homeowners insurance claim when they refused to pay the bill for his failure to give 10 days’ notice before filing suit, among other things. He claimed his “non-emergency indoor environmental assessment” agreement with the homeowner was not an AOB and thus wasn’t governed under HB-7065, the legislature’s 2019 AOB reform law. American Integrity wrote in its brief that “If it looks like a duck and quacks like a duck, then it is a duck.” Judge Edward LaRose agreed, writing in the appellate opinion, “The AOB is an ‘assignment agreement’ under section 627.7152, regardless of Air Quality’s attempts to disguise it as something else.”

This is the same Richie Kidwell who last year was explaining on a podcast how to game the 2019 AOB law. He also heads the Restoration Association of Florida, which has a federal court case pending against the state for the legislature’s 2021 Reform under SB 76. In August, he and Air Quality Assessors had one of their three state lawsuits thrown out of court that object to this year’s Senate Bill 2-D that prohibits awards of attorney fees to contractors or other assignees of AOB contracts.

LMA Newsletter of 10-10-22