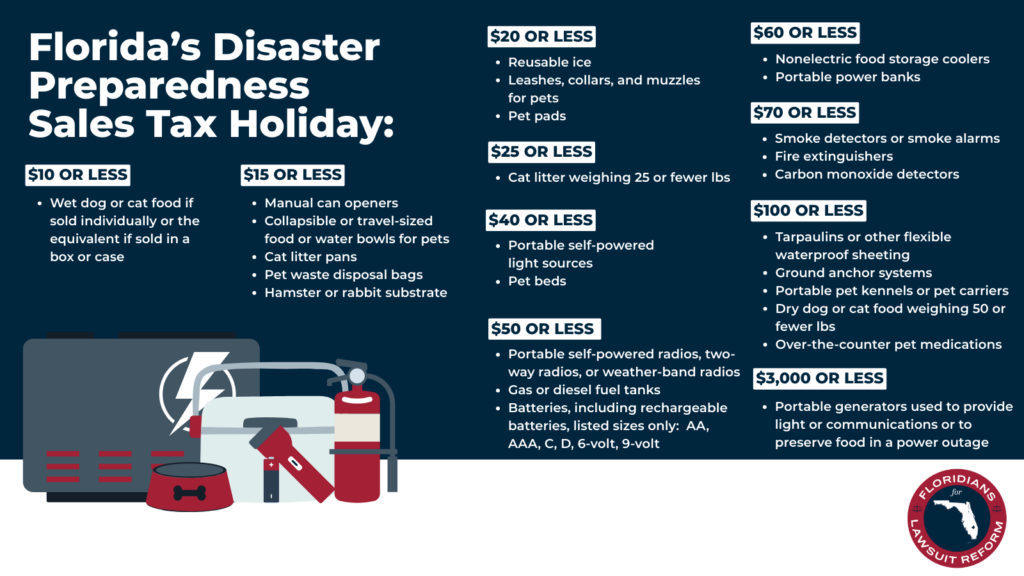

As hurricane season kicks in, people will have an opportunity to stock up on storm supplies without paying sales tax.

From Saturday, June 1, 2024, to Friday, June 14, 2024, you will be able to get items related to disaster preparedness tax-free.

According to the Florida Department of Revenue, here are some examples of items that will be tax-free:

Sales price of $20 or less:

- Reusable ice (ice packs)

Sales price of $20 or less:

Any portable, self-powered light source (battery, solar, hand-crank, or gas)

- Candles

- Flashlight

- Lanterns

Sales price of $50 or less:

- Any gas or diesel fuel container, including LP gas and kerosene containers

Batteries, including rechargeable batteries, listed sized only (excluding automobile and boat batteries):

- AAA-cell

- AA-cell

- C-cell

- D-cell

- 6-volt

- 9-volt

Portable Radios (powered by battery, solar or hand-crank)

- Two-way

- Weather band

Eligible light sources and radios qualify for the exemption even if electrical cords are included.

Sales price of $60 or less:

- Coolers and ice chests (food storage; nonelectrical)

- Portable power banks

Sales price of $70 or less:

- Carbon monoxide detectors

- Fire extinguishers

- Smoke detectors or smoke alarms

Sales price of $100 or less:

- Bungee cords

- Ground anchor systems

- Ratchet straps

- Tarpaulins (tarps)

- Tie-down kits

- Visqueen, plastic sheeting, plastic drop cloths, and other flexible waterproof sheeting

Sales price of $3,00 or less:

- Portable generators used to provide light or communications, or to preserve food in the event of a power outage

There is no limit on the number of tax-free items that can be purchased.

The second holiday period begins on Saturday, Aug. 24, 2024, and ends on Friday, Sept. 6, 2024.