Florida’s top five auto insurance groups are cutting personal auto rates by a statewide average of 6.5% due to legislative reform which addressed legal system abuse and assignment of benefits (AOB) claim fraud, the Florida Office of Insurance Regulation (OIR) announced Tuesday.

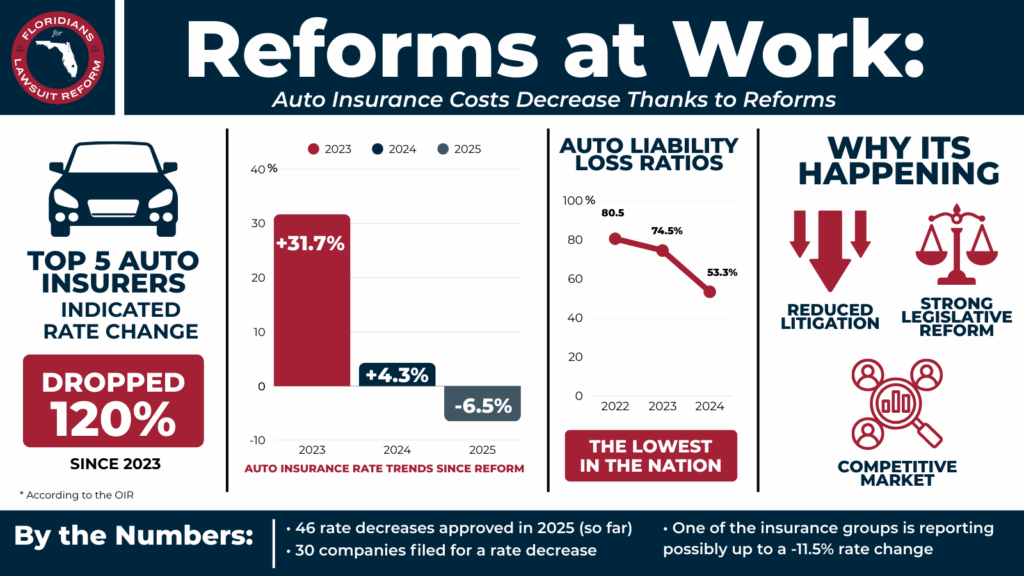

The big picture: State leaders credit the historic reforms for driving down both average rates and loss ratios, with Florida now reporting the lowest personal auto liability loss ratio in the U.S., OIR said.

- Improved underwriting results and reduced litigation are helping insurers lower premiums, while increased consumer shopping is boosting competition and affordability across the state’s auto insurance market.

By the numbers:

- 6.5% average statewide rate decrease filings for Florida’s top five auto insurance groups 2025 year-to-date, compared to +4.3% in 2024 and +31.7% in 2023. The top five writers represent 78% of Florida’s personal auto market.

- 53.3% personal auto liability loss ratio in 2024, down from 80.5% in 2022 and 74.5% in 2023.

- 46,000 glass claim lawsuits filed in 2023, following 37,000 in 2022 — before lawmakers banned AOB for glass claims.

- Top five personal auto groups in Florida in 2024, according to AM Best: Progressive Insurance Group (24.47% market share); Berkshire Hathaway Insurance Group (19.82%); State Farm Group (17.57%); Allstate Insurance Group (10.54%); and USAA Group (6.22%).

What they’re saying: “The continued reduction in auto insurance rates is yet another sign that Florida’s reforms are working,” said Florida Gov. Ron DeSantis. “We will protect our reforms from those who seek to undo them and continue to fight for Floridians.”

What we’re saying: Premium relief for Florida drivers comes on top of significant improvements in the state’s property insurance market, where many consumers are securing better rates for their home insurance due to legislative reform and a competitive market with more than a dozen new carriers, Triple-I’s Mark Friedlander told BestWire.

- Friedlander added, “For many years, unscrupulous glass vendors preyed upon Florida drivers at car washes, gas stations and shopping center parking lots with promises of gift cards in exchange for signing over their glass repair. When insurers rejected these highly inflated claims, frivolous lawsuits followed.”