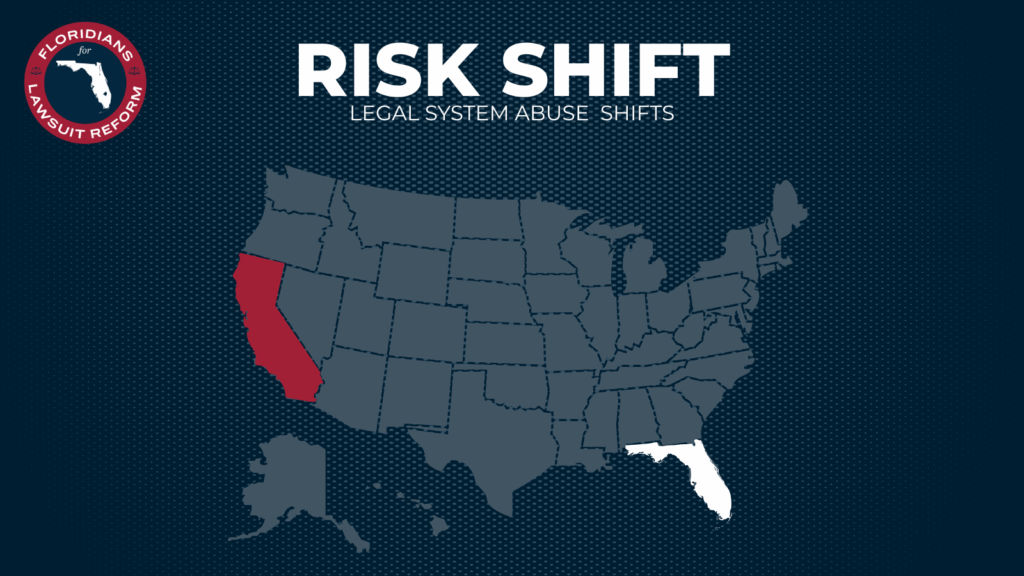

California appears to have supplanted Florida as the state with the weakest property insurance market, with newly released data showing unprecedented numbers of Californians cannot find coverage.

California’s property insurance crisis has grown increasingly dire in recent months while Florida has staged a stunning turnaround.

In Florida, the insurance market is starting to benefit from laws enacted in 2022 after claims from major storms put roughly a dozen local insurance companies out of business, experts said.

Advertisement

But California continues to see insurers withdraw from wildfire-prone areas, despite new policies this year to improve the insurance market. At the same time, the Los Angeles wildfires in January generated billions of dollars in claims that insurers are struggling to pay.

“The private insurance industry is still cherry-picking the least risky homes and dumping more Californians on the insurer of last resort,” said Carmen Balber, executive director on Consumer Watchdog, a California consumer advocacy group.

The contrasting trends are evident in the number of households in each state that cannot find property coverage and must buy policies from a state-chartered insurer of last resort. The amount of coverage provided by state-chartered insurers is widely used to measure the health of a state’s property insurance industry.

Insurance companies continue to drop policies and withdraw from hazardous areas — both in California and elsewhere — as disasters such as wildfires become increasingly destructive due to climate change and development.

Rising exposure

In California, the state-chartered insurer is undergoing unprecedented growth.

The number of policies in the California FAIR Plan nearly doubled between September 2023 and June 2025, newly released data shows. As of June 30, the plan had 610,000 policies, up from 330,000.

Florida, however, has seen the policies under its state-chartered insurer drop to 780,000 from 1.4 million over the same period. The state was the epicenter of the nation’s insurance crisis just a few years ago, prompting laws to improve the market — including changing legal rules to help insurers defend lawsuits alleging inadequate claims settlements.

“Those reforms were passed by 2022. You’ve got three years worth of improvement in that market because of some of those reforms,” said David Blades, an associate director at A.M. Best ratings company.

The California FAIR Plan now insures a majority of households in four heavily forested, Northern California counties that are vulnerable to wildfire, according to an analysis by POLITICO’s E&E News.

Statewide, the California plan insures 4 percent of households, with urban counties having much lower coverage rates. In Los Angeles, the coverage rate is 4 percent and grew slightly after the devastating wildfires in January.

But more significant than the number of policies is their value and the financial liability of the California plan.

The plan now insures $650 billion worth of property — more than double the amount it insured in September 2023 — which raises concerns for residents throughout the state. In comparison, the exposure of state-chartered Florida Citizens Property Insurance Corp. fell to $295 billion in June from $620 billion in September 2023.

The California plan’s exposure is expected to grow as market conditions persist — and a new policy takes effect increasing the plan’s coverage limits from $20 million per property to $100 million per property. The policy aims to help homeowner associations get coverage from the FAIR Plan.

California’s plan, like similar plans in other states, has legal authority to impose surcharges on insurance companies statewide if it cannot pay all claims.

In February, after the Los Angeles wildfires caused tens of billions of dollars in damage, California Insurance Commissioner Ricardo Lara allowed the plan to impose $1 billion in assessments on insurers in the state to pay the wildfire claims. It was the first time the plan imposed assessments since a major earthquake in 1994.

California’s strategy

Lara, the California insurance commissioner, has launched a new strategy aimed at helping property insurers financially.

One policy lets insurers use climate models to set their rates — a practice that had been barred under the state’s Proposition 103, which voters approved in 1988.

“This is about reforming the limits of Proposition 103 and delivering on the promise of insurance access for every Californian,” Lara said in a June 25 news release.

Consumer groups opposed the policy, which they said lets insurers set rates using proprietary models with no transparency. Insurers and environmental groups praised the policy for letting insurers consider future conditions instead of relying solely on claims from previous years.

Lara’s other policy lets insurers pass some of the FAIR Plan assessments to policyholders.

Compared to Florida, California is “not as far along in terms of benefiting from improvements in that marketplace,” Blades of A.M. Best said. “That’s one reason you’re still seeing policies go into the FAIR Plan. You don’t have as many companies that have been looking to grow, especially from a new policies standpoint.”

Balber of Consumer Watchdog said Lara’s efforts are decreasing state oversight of insurers.

“His entire strategy has been to give the insurance industry everything they want and cross his fingers,” Balber said. “We still need stronger measures to hold the home insurance industry accountability in California.”

Lara said in a statement that as a result of his changes, Farmers Insurance has “reopened several of its coverage lines” in California and other insurers such as USAA “are staying in our state and are growing.”

Florida’s response to the insurance crisis was also to enact laws to help insurance companies. Meanwhile, Texas enacted laws in recent months to contain insurance rates in counties along the Gulf Coast.

A large share of policies are sold by the state-chartered Texas Windstorm Insurance Association. The association’s policy has steadily grown to 276,000 as of March 31 from 185,000 in 2020.

One new Texas law aims to reduce the association’s costs — and premiums — by easing the amount of reinsurance it must buy. Insurance companies routinely buy reinsurance to pay for claims after a catastrophic event. Reinsurance policies have become increasingly expensive.

On Monday, an association committee recommended for the first time since at least 2008 freezing insurance rates in 2026.

Correction: An earlier version of this article misstated the job title of David Blades of A.M. Best ratings company