Florida’s insurance market, the seventh-largest in the world, is in good shape as hurricane season comes to a close, according to the Office of Insurance Regulation.

Private companies have moved into the space and are taking pressure off the state’s insurer of last resort in the property sector.

Commissioner Michael Yaworsky told the House Insurance and Banking Subcommittee that nearly 1.6 million policies have recently been taken fromCitizens Property Insurance Corporation, reducing the load to 516,000 as of September.

He anticipates that by year end, there could be as few as 300,000 policies left in Citizens. And State Farm actually has more policies than the state company.

Conventional insurers are helping the property market return to health, creating conditions where the public company can strengthen reserves.

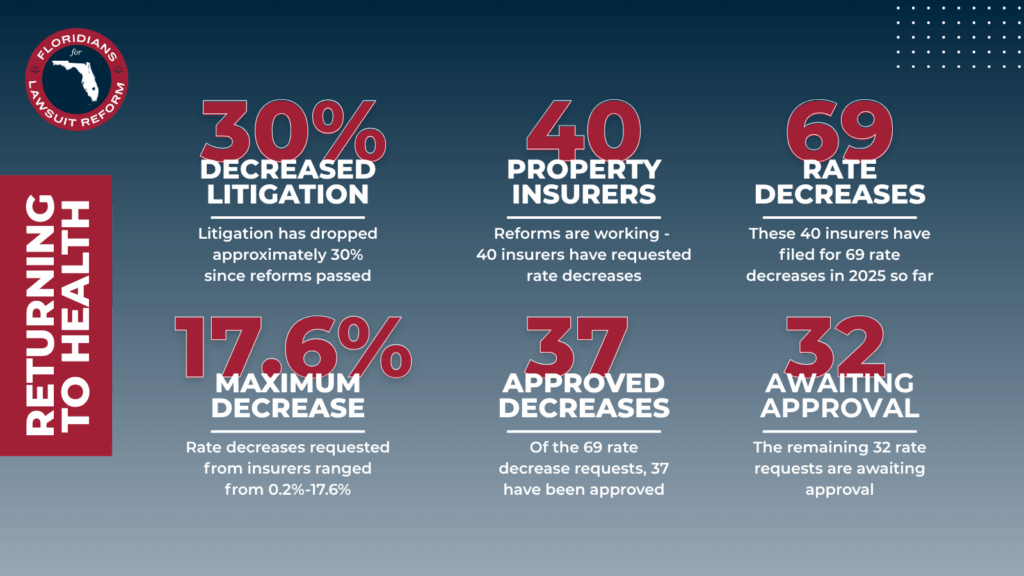

Litigation challenges are increasingly a thing of the past after legislative reforms, Yaworsky said, making Florida profitable once again for private companies in the space, despite an escalation in total insured value due to inflation this decade driving up commodity costs for repairs and replacement.

Yet consumers have recourse and are exercising it.

“While litigation has decreased about 30% and we’re seeing the benefits of that, there’s really no systemic evidence that the consumers don’t have the option to ultimately litigate if they want to,” Yaworsky said

“Even with that 30% reduction, we still have more litigation in the property space taking place than all other states combined times 2. So there’s really not a lot of evidence that there (aren’t) legal options. I see plenty of advertisements and other things that are up, and it seems to be a vibrant business.”

Yaworsky said rates overall are on a “negative glide path,” with a 0.8% increase over the last year “that was the lowest increase in the country compared to other states.”

Home hardening is one way people can get further rate relief, Yaworsky said, with mitigation reducing individual rates and impacts to the risk pool.

Auto insurance is also in a good place.

“Florida is seeing a significant number of rate decreases being filed in the PPA market. In 2025 to date, 40 insurers have submitted 69 rate decrease filings, ranging from -0.2% to -17.6%. Of these filings, 37 have been approved and 32 are currently under review,” states documentation presented to the committee.