| This week, Triple-I draws your attention to federal third-party litigation funding (TPLF) legislation that, if passed, would take much-needed steps to curb the harmful tactics being used to influence lawsuits in the federal court system, which has grown to be a multi-billion-dollar investment class. |

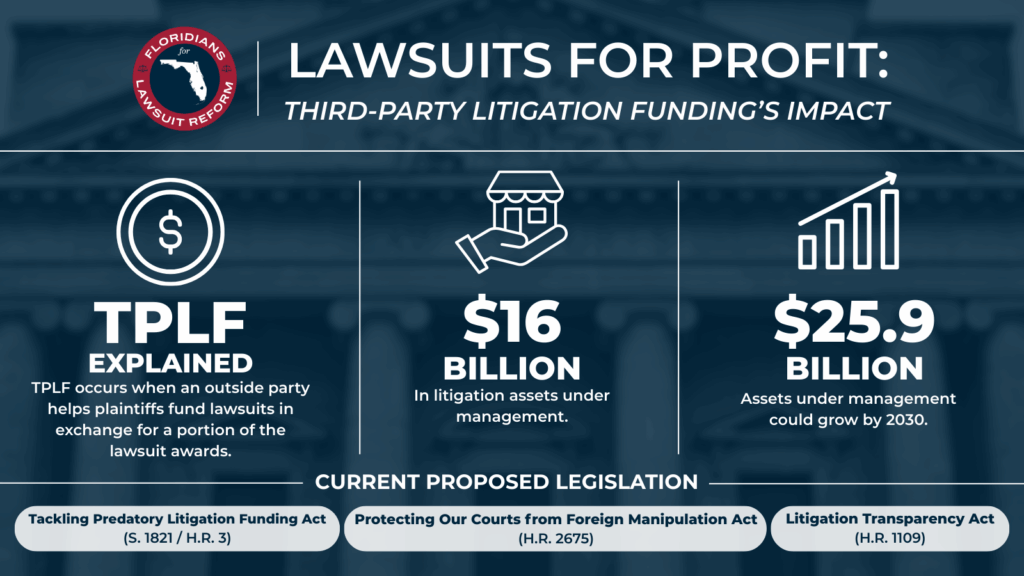

| TPLF Explained TPLF occurs when hedge funds or other outside parties help plaintiffs fund lawsuits in exchange for a portion of the lawsuit awards. These agreements often occur under opaque conditions, meaning that both the courts and opposing parties are not always aware of all the parties involved in litigation. This threatens the integrity of the entire U.S. legal system. In some cases, litigation financiers can influence lawsuit outcomes, potentially compromising attorney-client privilege and threatening the autonomy of plaintiffs. Most notably, TPLF drives up costs nationwide for consumers and businesses. Outside investment by dark money funders often leads to increased cases and prolonged litigation to maximize potential settlements and, in turn, their own financial returns. TPLF also creates a threat to America’s national security, as foreign investors can get involved in lawsuits and exploit the U.S. legal system to advance their interests. |

| The Rise of TPLF In 2024, outside funders had about $16 billion in litigation assets under management. Concerningly, this asset class is currently on track to expand rapidly, with estimatespredicting the market will grow to $25.8 billion by 2030. Absent significant changes to the current system, this practice will continue to expand. The monetization of lawsuits increases costs across the board — especially for small businesses, which often pass those expenses on to consumers. In the end, a select group of dark money investors benefit, while everyone else pays the price. |

| Federal Proposed Fixes Several bills currently sit before Congress that would address TPLF:Sen. Thom Tillis (R-N.C.) and Rep. Kevin Kern (R-Okla.) have sponsored the Tackling Predatory Litigation Funding Act in both chambers (S. 1821/H.R. 3), proposing increased federal taxes on funders, not the plaintiffs, for the proceeds won in lawsuits. This legislation would have closed a loophole allowing outside funders to profit heavily from lawsuits and fueling the growth of TPLF. While S. 1821 was not included in reconciliation legislation over the summer, Sen. Tillis recently announced plans to reintroduce the legislation. Rep. Ben Cline’s (R-Va.) Protecting Our Courts from Foreign Manipulation Act (H.R. 2675) would impose new TPLF restrictions by requiring disclosure of foreign funders, banning foreign governments and sovereign wealth funds from financing U.S. lawsuits, and preventing foreign governments from secretly influencing litigation outcomes. This bill recently passed out of the House Committee on the Judiciary and now heads to the full House.Rep. Darrell Issa’s (R-Calif.) Litigation Transparency Act (H.R. 1109), currently still with the House Judiciary Committee, would enact TPLF disclosure requirements in all federal civil cases to ensure transparency, prevent hidden agendas, and protecting national security. |

| Looking Ahead Now that the government shutdown has ended, there is an opportunity for progress on the federal level before the end of the year. Triple-I continues to bring awareness to the public and federal lawmakers about the devastating impacts of TPLF and the opportunities to protect Americans from legal system abuse. |