Home insurance is a growing financial burden for many Americans as extreme weather ramps up and rebuilding costs soar. Bankrate compared average home insurance premiums from Quadrant Information Services and median household incomes from the U.S. Census Bureau to calculate how much homeowners are spending to insure their properties. U.S. households spend an average of $2,470 per year on their home insurance policies, representing 3.18% of median household income.

AVERAGE ANNUAL PREMIUM$2,470

for $300K in dwelling coverage

HIGHEST TRUE COST OF HOME INSURANCELouisiana

highest percentage of income spent on home insurance

PERCENT OF INCOME SPENT3.18%

for $300K in dwelling coverage

LOWEST TRUE COST OF HOME INSURANCEVermont

lowest percentage of income spent on home insurance

Average annual premium

The national average cost of home insurance is $2,470 per year, or $206 per month.

How much do Americans pay for home insurance?

On the whole, average home insurance costs are up. Your exact home insurance costs will likely differ from the rates below, since premiums are customized to each homeowner. Factors like credit history, deductible level and filed claims have an impact on your premium. Getting familiar with average costs in different areas of the country can help you see how your rate compares. Use the interactive map below to view the true cost of homeowners insurance in all 50 states and 34 metropolitan statistical areas (MSAs).

Average annual premium

Percent of income spent

Change of percentage of income spent vs 2024

0.01%

Life events that affect cost

Filed a wind claim

Change in cost

Annual premium

Life events that affect cost

Filed a fire claim

Change in cost

Annual premium

Life events that affect cost

Filed a liability claim

Change in cost

Annual premium

Life events that affect cost

Filed a theft claim

Change in cost

Annual premium

Life events that affect cost

Deductible increased

Change in cost

Annual premium

Life events that affect cost

Credit score decreased

Change in cost

Annual premium

To find the true cost of home insurance in each state and MSA, Bankrate divided the average cost of a home insurance policy with $300K in dwelling coverage by each area’s median annual income. A higher ranking indicates a lower true cost of home insurance, while a lower ranking suggests the opposite. Importantly, home insurance premiums listed here do not include the cost of flood insurance.

The true affordability of home insurance in 2025 by state

| State | True Cost Ranking | Average annual premium | Percent of income spent |

|---|---|---|---|

| Alabama | 41 | $3,027 | 4.87% |

| Alaska | 3 | $942 | 1.09% |

| Arizona | 28 | $2,309 | 2.99% |

| Arkansas | 42 | $3,103 | 5.29% |

| California | 21 | $1,976 | 2.07% |

| Colorado | 35 | $3,413 | 3.67% |

| Connecticut | 17 | $1,668 | 1.82% |

| Delaware | 4 | $964 | 1.19% |

| Florida | 48 | $5,735 | 7.82% |

| Georgia | 25 | $1,966 | 2.63% |

- Louisianans (True Cost Rank #50), with a median household income of $58,229 and an average insurance rate of $6,274, spend 10.78% of their income on home insurance.

- Nebraskans (True Cost Rank #49), with a median household income of $74,590 and an average insurance rate of $6,425, spend 8.61% of their income on home insurance.

- Floridians (True Cost Rank #48), with a median household income of $73,311 and an average insurance rate of $5,735, spend 7.82% of their income on home insurance.

What do the three states with the highest true cost of home insurance have in common? They all face extreme weather conditions, which pose financial risks to insurance companies — risks homeowners pay for in their premiums. Louisiana and Florida are frequently struck by hurricanes, while Nebraska homes are at risk for tornado and hail damage. Extreme weather means more home insurance claims and higher premiums.

Of the 34 MSAs analyzed, New Orleans-Metairie homeowners spend the highest percentage of their income on homeowners insurance — an eye-watering 17.48 percent. New Orleans has both the highest average premium among MSAs we analyzed and the lowest median income, contributing to the real budget squeeze for homeowners in the metro. Miami-Fort Lauderdale-West Palm Beach is the second-costliest, with homeowners spending 13.37 percent of median annual income on average insurance premiums.

On the other end of the spectrum, Vermont has the lowest average home insurance premium and best True Cost Ranking. Homeowners in the Green Mountain State spend just 1.03 percent of their median annual income on homeowners insurance premiums with an average premium of $834 per year. Vermont’s neighbor to the east, New Hampshire, earned the second-best True Cost Ranking. There, home insurance eats up just 1.07 percent of annual income and costs an average of $1,036 per year.

Some areas of the country offset higher home insurance premiums with higher median incomes. In the Denver-Aurora-Centennial MSA, the average $300K home insurance policy costs $3,644 per year — well above the national average — but homeowners there earn a median annual income of $103,055, resulting in just 3.54 percent of their pay going toward premiums. California has a similar pattern. While average home insurance rates are comparatively high in Los Angeles-Long Beach-Anaheim, San Diego-Chula Vista-Carlsbad, San Francisco-Oakland-Fremont and Riverside-San Bernardino-Ontario, homeowners in those MSAs spend less than 3 percent of their median incomes on premiums.

How much have home insurance rates increased?

Nationally, the average cost of home insurance has increased 9 percent since 2023, with premiums now costing $209 per year more than they did two years ago. From 2023 to 2024, home insurance costs increased by $104 per year (4.6 percent), and again by $105 (4.4 percent) from 2024 to 2025.

Home insurance rates rose the fastest in California; from 2023 to 2025, the average cost of a policy rose by 41 percent. During that same time period, median state income only increased by 12.5 percent. Zooming into the Golden State, average home insurance costs in Los Angeles, San Diego and Riverside increased the most out of the 34 metros Bankrate analyzed.

The increasing cost of home insurance in Michigan also significantly outpaced income growth. Annual median income increased only slightly from 2023 to 2025, rising by less than 9 percent. Over that same time period, the average cost of home insurance shot up 29 percent, from $1,819 to $2,351.

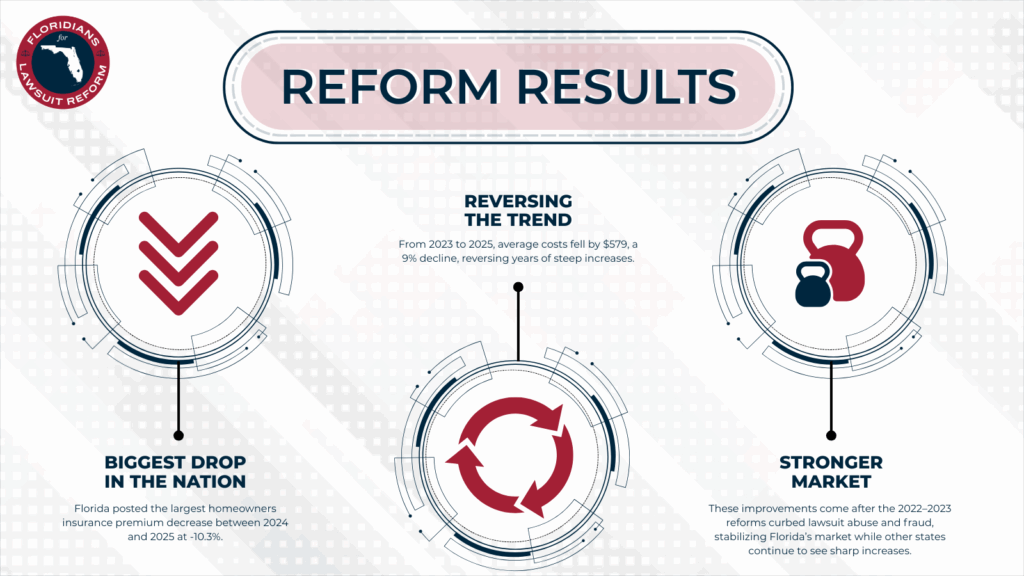

Florida has long been in the headlines for its expensive home insurance market, but its legislative overhauls may finally be working. While Florida has one of the highest average home insurance costs in the nation, premiums actually appear to be decreasing. From 2023 to 2025, home insurance costs in Florida decreased by an average of $579, representing a 9 percent drop. Looking closer, average home insurance costs in the Florida MSAs decreased the most compared to the other metros included in this study. At the state level, Alaska homeowners saw the most relief in their home insurance premiums. From 2023 to 2025, the average cost of a policy went from $1,131 to $942 annually, a nearly 17 percent drop.

Largest premium increase by state

Largest premium increase by MSA

Smallest premium increase by state

Smallest premium increase by MSA

Largest premium increase by state2023202420250$1,000$2,000$3,000$4,000

Credit impacts home rates more than claims filing

Your home insurance company considers a myriad of factors when pricing your policy. These include home specifics — your roof’s age, square footage and building materials to name a few — but they also include factors specific to you as a policyholder. Your carrier considers your claims history, coverage choices and, in most states, your marital status and credit history.

While we often think of credit impacting interest rates and loan eligibility, it has a huge impact on home insurance rates, too. In every state, except for California and Maryland, your insurance company is allowed to use your credit history when calculating your premium. Homeowners with good or excellent credit are typically rewarded with lower home insurance rates, while those in the average or poor tier pay more.

A drop in credit can cost you significantly, even more than filing a claim. Moving from the “good” to “poor” credit tiers raises average home insurance rates by 63 percent, an extra $1,557 per year. To compare, filing a wind, fire or liability damage claim raises premiums by an average of 5 percent.

- The average cost of home insurance in Nebraska increased by $6,201 after a drop in credit, the highest dollar amount of any state.

- Oklahoma and Michigan saw the second and third highest rate increases following a drop in credit, an additional $5,590 and $5,005 per year, respectively.

- Homeowners in Oklahoma City see the biggest jump in rates after a drop in credit among MSAs, with average rates increasing by $6,575 per year.

Weathering the storm comes at a cost

The United States is experiencing an uptick in billion-dollar weather disasters. An average of nine billion-dollar weather events struck the U.S. per year from 1980 to 2024, according to the National Oceanic and Atmospheric Administration. Looking closer at the 2020 to 2024 timeframe, the annual average is significantly higher at 23 events per year. In 2024 alone, extreme weather events cost the U.S. upward of $181 billion. And when the weather gets worse, home insurance usually becomes more expensive.

Wind

There are around 66 million U.S. homes at moderate or greater risk for tornado damage, according to Cotality’s 2025 Severe Convective Storm Report. Around 1.3 million of these homes are in Oklahoma, where homeowners already pay home insurance premiums 87 percent higher than the national average. Filing a wind damage claim pushes average homeowners insurance rates up to $5,138 per year — more than double the national average cost of a policy with no claim history. However, average home insurance costs in the state did decrease from 2024 to 2025 by 8 percent.

Nebraska homeowners pay the highest average home insurance costs in the country, although average premiums don’t change much after filing a wind claim. Per Bankrate’s analysis, a $12,000 wind damage claim only raises insurance costs by an average of $63 per year. Although the increase from filing a wind claim is fairly marginal, Nebraska home insurance is getting pricier overall. From 2023 to 2025, homeowners saw an extra $881 added to their premiums on average. This represents an increase of almost 16 percent.

In areas of the country prone to certain losses, insurers can charge separate — and usually higher — deductibles for specific perils. States with high wind exposure can, for example, come with specific wind damage deductibles, which can sometimes help keep base policy costs lower.

Hurricanes

Florida is nearly synonymous with tropical storms, with more than 8.1 million homes at moderate or greater risk for hurricane wind damage, according to Cotality. Florida homeowners already pay the third-highest average premiums in the country ($5,735 per year) and have the third-lowest True Cost Ranking, allocating 7.82 percent of their annual income to home insurance. After a wind claim, Florida homeowners see their home insurance costs rise by an average of 5 percent to $6,015 per year. Florida home policies have to include wind coverage and commonly have a separate hurricane deductible, but some homeowners may be able to opt out of wind coverage.

Annual income in the Miami MSA is higher than the Florida average, but so are the home insurance premiums. Miami homeowners spend an average of 13.37 percent of their income on home insurance premiums, or $10,194 annually — 5.5 percentage points higher than the Florida average. Miami’s elevated home insurance costs can, in part, be credited to its coastal location and higher hurricane risk. Like the rest of Florida, home insurance premiums in Miami have veered down over the past few years, with policies costing 9 percent less than they did two years ago. However, a wind damage claim can mitigate some of those savings. After filing a wind damage claim, the average cost of home insurance rose by $287 annually.

Louisianans are also no strangers to hurricanes. The Bayou State boasts the second-highest average home insurance premiums in the country, and homeowners here spend the largest portion of their income on premiums compared to other states. But, unlike Florida, Louisiana homeowners insurance is only getting pricier. From 2023 to 2025, Louisiana homeowners saw their premiums go up by an average of $665 (12 percent), bringing the statewide average to $6,274 per year. Louisiana’s home insurance rates are already high, but filing a claim for wind damage doesn’t bring them much higher — only adding an average of $69 per year to your home insurance bill.

Spending an average of 17.48 of their annual incomes on insurance, New Orleans homeowners spend the most for their coverage compared to every state and MSA analyzed in this study. Like the rest of Louisiana, filing a wind damage claim in The Big Easy brings costs up, but not by much, only by an average of $84 per year. Average home insurance rates in New Orleans are rising faster than the rest of the state; from 2023 to 2025, the average cost of a policy increased by 14 percent, a total of $1,307 out of homeowners’ pockets.

While hurricanes can cause both devastating wind and flooding, flood damage is not included in your home insurance policy. To be financially protected from a flood, you’ll need separate flood coverage.

Wildfires

Wildfire risk is highest in the western U.S., with California leading the pack. The state has the highest concentration of homes with moderate or higher wildfire risk — upward of 1.2 million, according to Cotality’s 2025 Wildfire Risk Report. Colorado has the second highest, with more than 318,000 homes.

California home insurance costs are low compared to median household income, with homeowners spending just 2.07 percent of their annual income on insurance. Although price is a concern for many, it’s not the only thing vexing homeowners. California also has an insurance availability crisis, making it a challenge to secure a policy. Due to the heightened wildfire risk, insurance companies have been leaving the state in droves, leaving homeowners scrambling to find coverage. Insurance prices are tightly controlled by the state’s Department of Insurance, to the point where some insurers argue that they cannot raise rates high enough to fully account for the risk of insuring a California home. Despite this, the average cost of home insurance in the state has risen 41 percent since 2023. Many California homeowners have resorted to the state’s FAIR Plan, an insurance option of last resort that usually covers less but costs more.

In 2025, Colorado debuted its FAIR Plan, making it the 34th state to offer one. It’s an eerily similar story to California’s: Insurers were leaving the state due to high wildfire losses, leaving homeowners with fewer options. From 2023 to 2025, the cost of homeowners insurance in Colorado inflated faster than the national average, ballooning by 14 percent.

What do these trends mean for you?

You can’t control the weather, and for many American homeowners, relocating to a different state isn’t a viable financial option. With home insurance costs on the rise in most states, there are a few things you can do to help keep costs manageable.

- #1Carefully consider your deductibles

- #2Filing a claim can be worth it

- #3Make home insurance a larger piece of the real estate puzzle

Carefully consider your deductibles

Choosing a higher deductible can help keep home insurance costs low without losing coverage. Raising your deductible from $1,000 to $5,000 lowers average home insurance costs by 19 percent, or $463 per year. Most carriers offer an array of deductible options, and putting those savings in an emergency fund can help you cut costs while ensuring you have money set aside to pay your deductible if you do need to file a claim. Savings are a critical part of this strategy — 15 percent of U.S. homeowners say they’d be unable to pay their deductibles without incurring debt, according to Bankrate’s Extreme Weather Survey.

North Carolina homeowners stand to save the most by raising their policy deductible. Average home insurance rates drop by $1,177 per year when increasing a home policy deductible to $5,000. This represents a 44 percent decrease. In Oklahoma City, homeowners saw their rates decrease by an average of $1,046, the highest of all the MSAs Bankrate reviewed.

Keep in mind that you may have more than one deductible on your policy depending on the type of loss. For example, wind, hail and hurricane damage may require a separate deductible from your standard coverage, and they’re usually calculated percentages of your dwelling limit (instead of a flat dollar amount). Understanding these distinctions can help you plan for out-of-pocket costs more accurately.