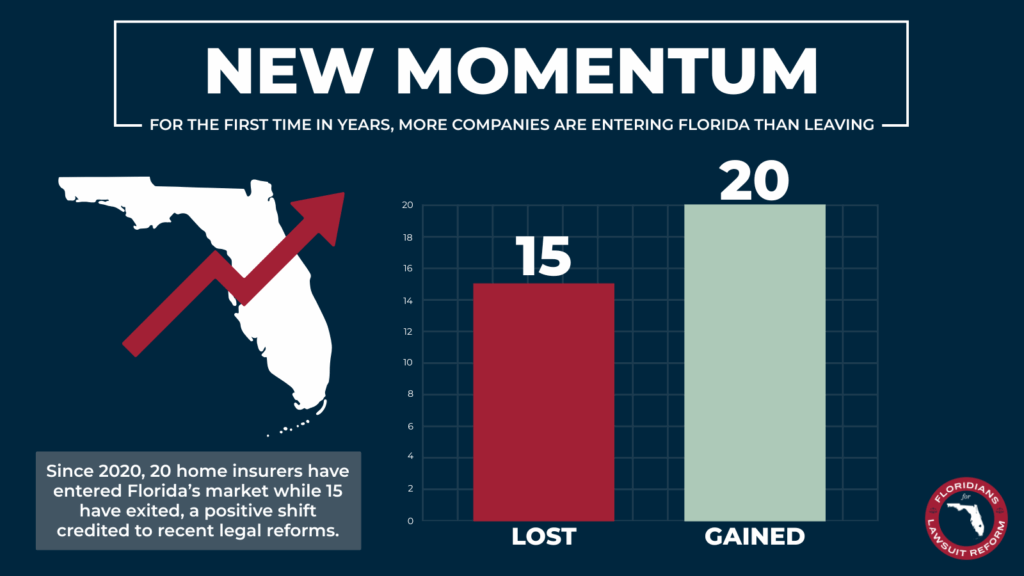

Two more property insurers started doing business in Florida this summer, boosting competition in a market clawing back from an insurance industry crisis. The new insurers bring the total number of insurers entering the state to 14 since early 2023 — exceeding the number of property insurer insolvencies that occurred from 2020 to 2023.

One of the latest new insurers, Incline National Insurance, will offer homeowners and auto insurance policies, among other products. The other, Florida Insurance and Reinsurance, or Florida Re, will focus on condominium coverage. Condo insurance rates have increased since the deadly 2021 collapse of the Champlain Towers South condo building in Surfside, Florida.

The two new insurers are the latest sign that, despite Florida’s high hurricane risk, new state laws are making the market attractive for insurance companies again.

“Legislative reform that addressed the man-made factors that caused the Florida risk crisis — legal system abuse and assignment of benefits claim fraud — has generated an environment where property insurers can write profitable business,” said Mark Friedlander, senior director of media relations for the Insurance Information Institute (Triple-I).

Insurance rate reductions also signal a turning point for Florida’s insurance crisis. Insurers file for rate increases with the Florida Office of Insurance Regulation. Florida had the lowest average rate filing increase (1%) last year, according to S&P Global. And some insurers lowered premiums in the state.

Climate risk threatens Florida’s recovering insurance market

New insurance companies could help stabilize Florida’s insurance rates. But homeowners in high-risk areas can still expect rising premiums.

The average annual cost of insuring a $300,000 home in Florida climbed to $14,140 in 2024, according to Insurify data. And Insurify data scientists project rates will exceed $15,000 by the end of this year.

“More insurers covering a high-risk area spreads the risk, so one company isn’t shouldering it all,” said Julia Taliesin, data journalist at Insurify. “But it doesn’t change the fact that climate change is increasing the cost of property ownership in high-risk regions of the U.S.”

Florida home insurance companies increased policy non-renewals by 280% between 2018 and 2023, leaving high-risk homeowners without coverage.

Hurricane Ian caused $22.4 billion in insured losses, mostly to residential property, in 2022. The storm strained the state, already in the depths of the insurance crisis, causing some insurers to pull back on policy writing or leave Florida entirely.

Florida’s new private insurance companies may still deem high-risk properties uninsurable. Homeowners who can’t buy insurance in the standard market typically turn to Citizens Property Insurance Corporation, Florida’s already-overloaded state-backed insurer of last resort.

What’s next? Lower premiums and more insurance options

Florida’s insurance market shows promising signs of recovery despite climate risks that challenge insurer profitability.

“Insurance agents are reporting they are requoting their customers at prices up to 50% lower than last year,” said Friedlander. “The market has improved dramatically, and consumers are benefiting, with more options for coverage and lower premiums.”

Florida homeowners whose premiums have risen in recent years may also find better rates as the market recovers by comparing insurance quotes when their policy is up for renewal.

High-risk property owners can invest in long-term solutions, like replacing old roofs with weather-resistant materials. The My Safe Florida Home program grants homeowners up to $10,000 for hurricane-fortified roof and window replacements, which can mitigate damage during the next storm. Insurers sometimes offer lower premiums for homes with these upgrades.