Florida properties that have been repeatedly flooded and rebuilt under the federally-backed National Flood Insurance Program (NFIP) have cost U.S. taxpayers hundreds of millions of dollars. Some flooded homes in the state have been rebuilt over a dozen times, according to a new analysis by the Natural Resources Defense Council (NRDC), the Fort Myers News-Press reported.

The big picture: NRDC’s report shows the increasing frequency of flooding in Florida, fueled by climate risk and the state’s geographical vulnerability to hurricanes, is creating a costly cycle of damage and federally-funded rebuilding.

- This pattern, involving thousands of properties being rebuilt repeatedly at taxpayer expense, highlights the growing financial impact of climate risk. It also prompts questions about the viability of current policies and the necessity for more proactive measures to manage flood risks and development in high-risk areas.

- In June 2022, the Biden administration proposed major changes to NFIP, which would include dropping coverage for homeowners who receive repeated claims payments.

By the numbers:

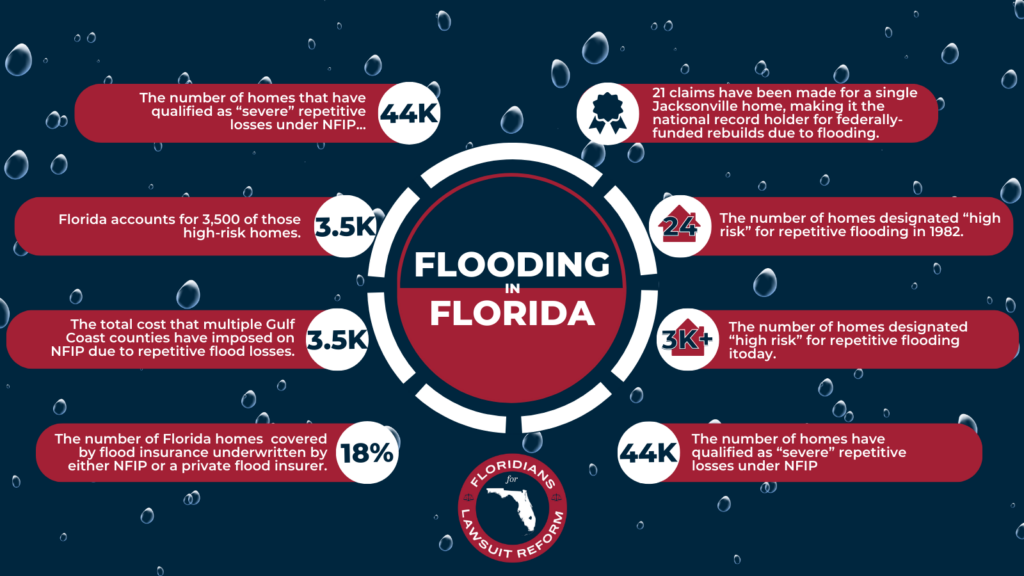

- 21 claims have been made for a single Jacksonville home, making it the national record holder for federally-funded rebuilds due to flooding.

- From 24 in 1982 to more than 3,000 today, the number of Florida homes designated as “high risk” for repetitive flood losses has seen a significant increase.

- 44,000 homes across the U.S. and its territories have qualified as “severe” repetitive losses under NFIP, with Florida accounting for 3,550 high-risk properties.

- $265 million is the total cost that Hillsborough, Pasco, Escambia and Santa Rosa counties, along with the city of St. Petersburg and the Pensacola Beach-Santa Rosa Island Authority, have imposed on NFIP due to repetitive flood losses.

- Approximately 18% of Florida homes are covered by flood insurance underwritten by either NFIP or a private flood insurer. The U.S. take-up rate for NFIP coverage is 4%.

What they’re saying: “The bottom line is that the flooding risks to communities are increasing faster than officials are dealing with them,” said Anna Weber, a senior policy analyst at NRDC. “Homeowners desperately need new measures that can help them afford flood insurance, reduce the risk of flooding, and give those who want it a real opportunity to move to safer ground,” Weber added, highlighting the urgency of the situation.