Florida home insurers collected more premiums than claims and expenses paid in 2024 — a rare occurrence, and even more so after three hurricanes struck the state that year.

- That’s according to new data from the state Office of Insurance Regulation.

Why it matters: Florida homeowners still face among the highest premiums in the nation, at an average of $3,815 per year.

Catch up quick: The Sunshine State’s vulnerability to storms has resulted in losses for insurers, which, in turn, are passed on to consumers.

- The result? A dismal insurance market, which for decades saw premiums skyrocket, companies go bankrupt, and an over-reliance on the state-run insurer, Citizens Property Insurance Corp.

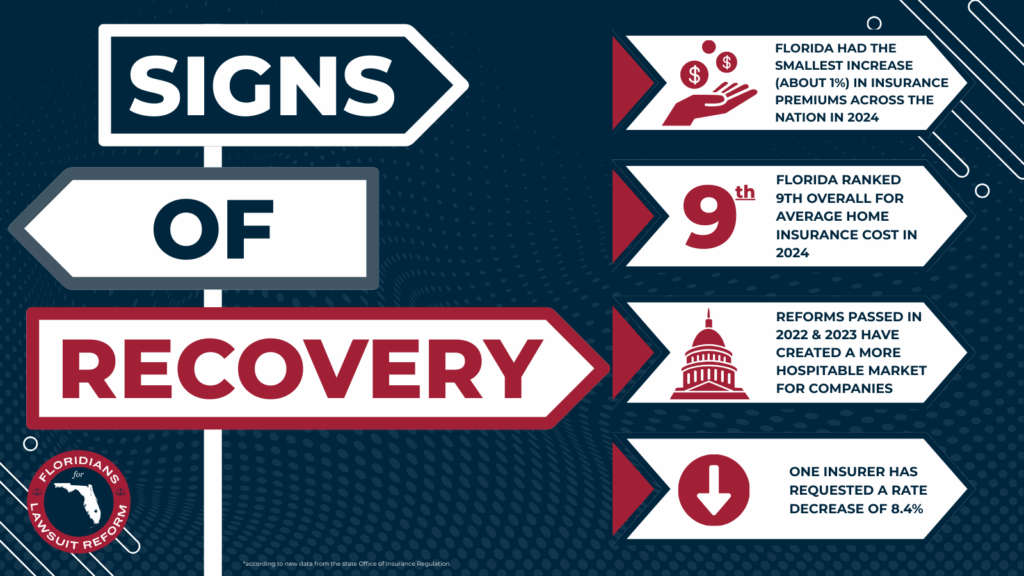

- The Legislature tried to flip that outlook in 2022, with reforms that aimed to create a more hospitable market for companies. But that didn’t mean much for consumers then, who got no such relief.

The latest: There are now signs of improvement, however modest.

- S&P Global found that Florida had the smallest increase (about 1%) in insurance premiums across the nation in 2024 and ranked it ninth overall for average home insurance cost that year.

- Dozens of new insurers have entered the market. All the while, the bloated state-run insurer offloaded tens of thousands of policies to the private sector, with some consumers now paying less.

- And last year, for the first time since 2015, home insurers raked in more than they paid out.

What they’re saying: “This is great news for consumers,” says Mark Friedlander of the Insurance Information Institute.

- “Florida’s always going to be above the national average because it’s a high-risk state,” he tells Axios. “But the market is improving.”

Yes, but: There’s a lot to couch here.

- For one, S&P Global didn’t account for Citizens — the state’s largest insurer — when it evaluated Florida’s rate increases, and a 6% statewide increasewent into effect this summer.

- Plus, most home insurance policies cover wind, not flood damage. That means a considerable amount of devastation that hurricanes Debby, Helene and Milton caused in Florida wasn’t covered.

What’s next: Florida Peninsula Insurance, among the state’s largest home insurers, requested a statewide decrease of 8.4% in its homeowners’ premiums last week, per WFLA.

- The state Office of Insurance Regulation must approve the rate change for it to take effect. If it goes through, policyholders could see their premiums decrease this year.