PENSACOLA, Fla. –The home insurance market is seeing skyrocketing rates across the country — and Florida leads the way in insurance prices.

The Sunshine State also ranked number one in 2024 for non-renewals.

Analysts say there’s a growing number of non-insured homeowners in the state.

Despite the numbers, recent policy changes in the Florida legislature are considered to be more impressive than any other state. From 2021 to 2022, property insurance rates in Florida spiked 45%.

Many factors led to the increase, but the the Florida insurance commissioner says the entire system is being rebuilt to stop the massive rate hikes.

“For better or worse, we all pull our wrists together and we all ultimately succeed or fail,” Florida Insurance Commissioner Michael Yaworsky said.

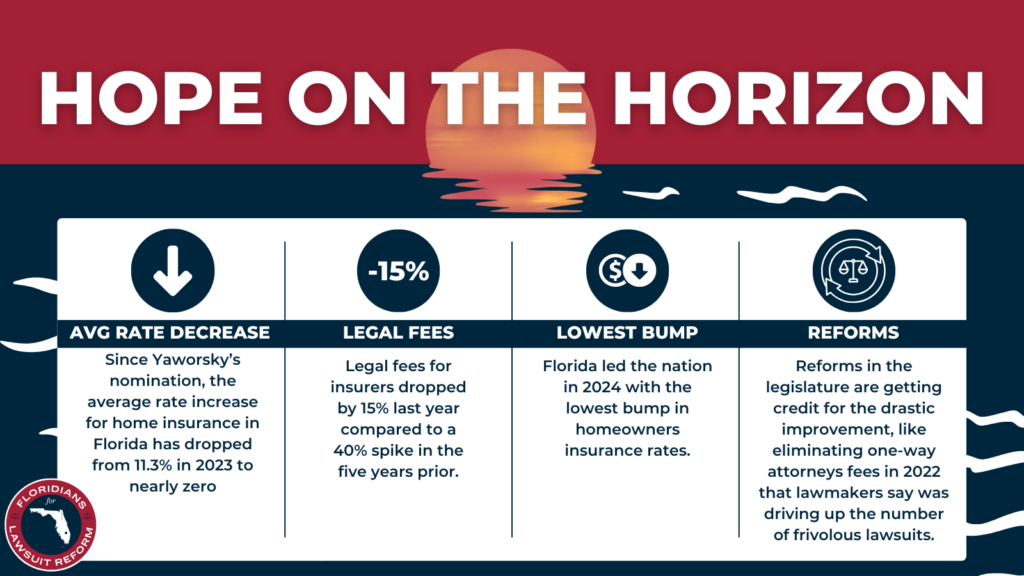

Since Yaworsky was nominated by Governor Ron DeSantis to serve as Florida insurance commissioner, the average rate increase for home insurance in Florida has dropped from 11.3% in 2023 to nearly zero (0.5% in 2025).

Reforms in the legislature are getting credit for the drastic improvement, like eliminating one-way attorneys fees in 2022 that lawmakers say was driving up the number of frivolous lawsuits.

“We were in a place a couple years ago where policyholder dollars were being used to pay for excessive litigation and we moved to a place where that’s no longer the fact and you see that all throughout the system,” Yaworsky said.

Data proves the reforms are being felt throughout the region.

A January report from the Treasury Dept. found legal fees for insurers dropped by 15% last year compared to a 40% spike in the five years prior.

The state also led the nation last year with the lowest bump in rates. It’s a relief for many.

“I actually was very excited it was only $700. Given the past years,” Pensacola homeowner Anna Stockton said.

Stockton bought her Pensacola home four years ago. She says a $700 rate hike last year is nothing compared to previous years. However, she feels the market is pushing everyone out.

“I’ve gone up almost $5000 in the last four years,” Stockton said. “I bought this house with the intention of giving my kids a forever home that they would always be able to come back to. A place to come home to for Christmas with their families. I have to consider if that’s a possibility anymore.”

With roughly one in five Florida homeowners living without insurance, Stockton says she too would fall in line if her mortgage were paid off.

“I would self-insure absolutely. I would take the money that they’re making off me,” Stockton said. “I’ve never had a claim. This year they’re going to make $8,000 off me. I would invest it, let it grow, then I could just take care of it myself.”

More reform could be coming.

A companion bill filed in the legislature earlier this month by Northwest Florida lawmakers Don Gaetz and Alex Andrade aims to lower the cost of insurance rates by cracking down on rate hikes and demanding more transparency from insurers.

Homeowners like Stockton say they’re watching the legislature closely as it could mean the difference between staying in her home or finding a new state to live in.

“I’m very hopeful of that. Something needs to be done,” Stockton said. “I’ve often called it a lawless land, it feels like nobody’s regulating that.”

The insurance commissioner says they’ll be looking at the proposed legislation in the house and senate. WEAR News is told there’s still a lot to work out in the bill to make sure it’s fair for both carriers and customers.