In 2024, the Florida Senate debated SB 1276, the “Litigation Investment Safeguards and Transparency Act.” The act would require a court’s consideration of potential conflicts of interest that could arise from the existence of a litigation financing agreement in specified circumstances as well as prohibit specified acts by litigation financiers and require certain disclosures related to litigation financing agreements.

While the bill died on the calendar, increased interest in investing in law firms by third parties, such as private equity firms, may soon bring this issue to the forefront again.

Third-Party Litigation Funding (TPLF) takes place when an external investor funds a lawsuit in exchange for a portion of the potential payout. Third-Party Investment in Law Firms is when outside investors gain ownership or a share of ownership in a law firm itself.

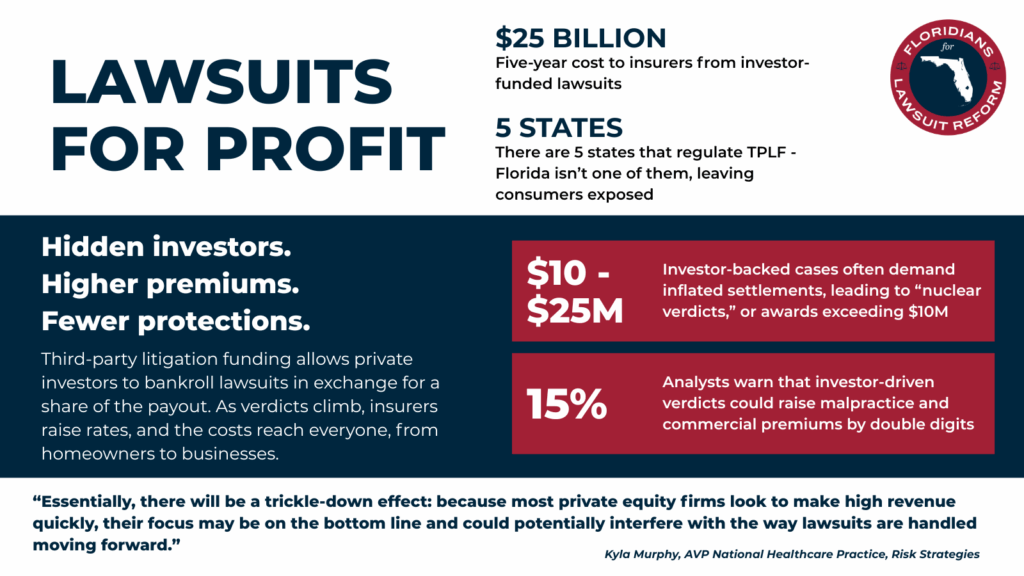

Currently, the only states that have passed laws to regulate third-party litigation funding are Colorado, Arizona, New York, Oklahoma, and Montana. Arizona is the only state that allows direct ownership of law firms by non-attorneys.

“While there is currently a rule in place that technically prohibits third-party litigation funding at this time, that may change in the future,” explained Kyla Murphy, AVP National Healthcare Practice, Risk Strategies.

Florida Bar Rule 4-1.8(f) states that a lawyer cannot accept compensation for representing a client from a third party unless the client gives informed consent; the arrangement doesn’t interfere with the lawyer’s professional judgment or the client-lawyer relationship, and the lawyer protects client information under Rule 4-1.6. This rule prevents conflicts of interest by ensuring the lawyer’s primary loyalty remains with the client, not the third-party payer.

According to Murphy, if third-parties are allowed to fund litigation or gain ownership shares in law firms, it will not only affect those involved in a lawsuit, but every single commercial insurer, including those who provide malpractice insurance.

“Essentially, there will be a trickle-down effect: because most private equity firms look to make high revenue quickly, their focus may be on the bottom line and could potentially interfere with the way lawsuits are handled moving forward,” Murphy said.

“This will also put extreme pressure on plaintiff’s attorneys,” she added. “Third-party investors will expect them to win big, because they have a lot of money invested in the case. This may result in nuclear verdicts, which will trickle down to affect insurance rates because the insurers have to pay these settlements. That means physicians will be paying more for premiums.”

According to a recent article in The Insurance Journal, the five-year cost to commercial insurers due to third-party litigation investments is estimated to exceed $25 billion.

“If settlements start to exceed $10 million or $25 million, insurers are going to raise premiums to offset these losses, which means that physicians will pay more,” said Murphy. “In the long run, these verdicts may contribute to shortages in healthcare because physicians will stop practicing because they can’t afford insurance, and new physicians may decide not to enter the field.”

For more information, contact Kyla Murphy at Kyla.murphy@risk-strategies.com or call (800) 966-2120.