Florida’s homeowners insurance market is beginning to show signs of recovery after many years of volatility, but persistent challenges may delay substantial premium relief for consumers in the foreseeable future, reported Barron’s.

The big picture: The state’s homeowners insurance market has been wrestling with a myriad of issues for several years including legal system abuse, claim fraud, population growth in coastal areas, increasing replacement costs, and climate-related risks. Florida incurred three landfalling hurricanes (Ian, Nicole and Idalia) between September 2022 and August 2023.

- These factors have resulted in soaring premiums and a decrease in private insurer capacity due to nine insolvencies since 2021, several voluntary market withdrawals and widespread policy non-renewals.

- Property insurance reform was passed during a special session of the Florida Legislature in December 2022. This included the elimination of one-way attorney fees and assignment of benefits for property claims – both considered major drivers of legal system abuse.

- As a result of impactful reform, market conditions have improved in recent months. This includes six new property insurers entering the state and several hundred thousands policies of state-backed Citizens Property Insurance Corp. moving to the private market via depopulation.

By the numbers:

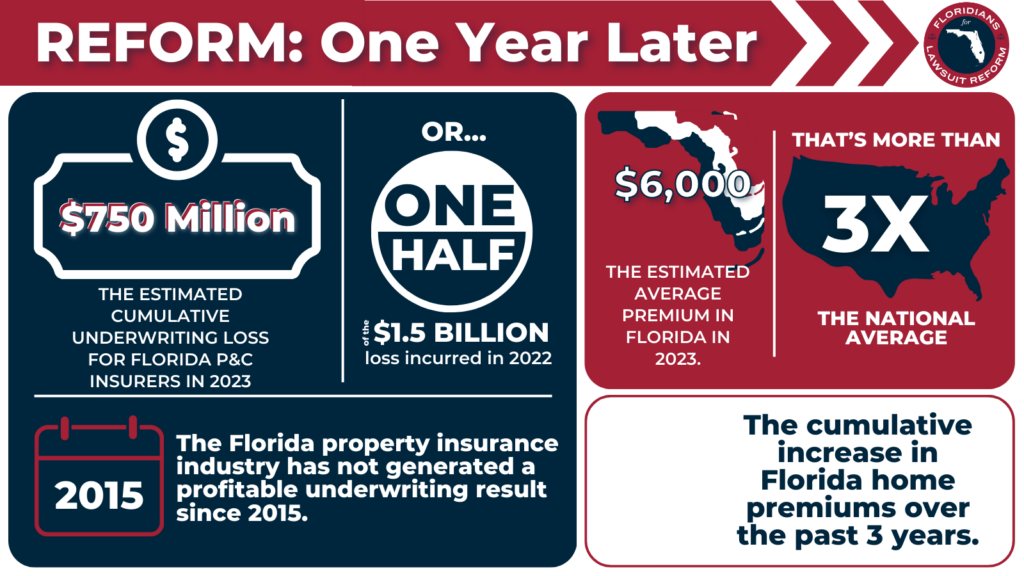

- $750 million is the estimated cumulative underwriting loss for Florida property/casualty insurers in 2023, half of the $1.5 billion loss incurred in 2022. The Florida property insurance industry has not generated a profitable underwriting result since 2015.

- $6,000 estimated average homeowners insurance premium in Florida in 2023, more than triple the national average of $1,700.

- 102% cumulative increase in Florida home premiums over the past three years.

- 80% of litigated homeowners insurance claims are filed in Florida on average annually, despite accounting for only 9% of U.S. homeowners insurance claims per year.

- 1.22 million policies and $551 billion in total exposure are therevised 2023 year-end projections for Citizens, down from earlier projections of 1.7 million policies in force and $675 billion in year-end exposure.

What we’re saying: “The legal environment is improving, but there are hundreds of thousands of (previously filed) cases that have to work their way through the court system,” Triple-I’s Mark Friedlander told Barron’s.

- Friedlander added that reinsurance renewal rates will be a significant factor in how homeowners insurance rates are determined for 2024.

What they’re saying: “We are beginning to see some positive signs of availability of coverage, but that doesn’t necessarily mean that affordability will improve in the near term,” said Tim Zawacki, a principal research analyst for S&P Global Market Intelligence.

The takeaway: Despite recent improvements in Florida’s homeowners insurance market, the state’s residents may not experience significant premium relief in the near future due to persistent challenges such as climate-related risks and escalating reinsurance costs.